What the $27.39 rule means

The $27.39 rule is an easy way to think about a one-year savings goal. It says that saving about $27.39 per day adds up to roughly $10,000 over a 365 day year, and many personal finance guides use this daily framing to make an annual target feel actionable; see the NerdWallet guide for a clear daily breakdown NerdWallet guide on saving $10,000.

Framing a goal this way does not imply a return or investment outcome. It is arithmetic: you convert a single target into a cadence that fits daily life, and then choose how to hold or grow the money depending on your needs.

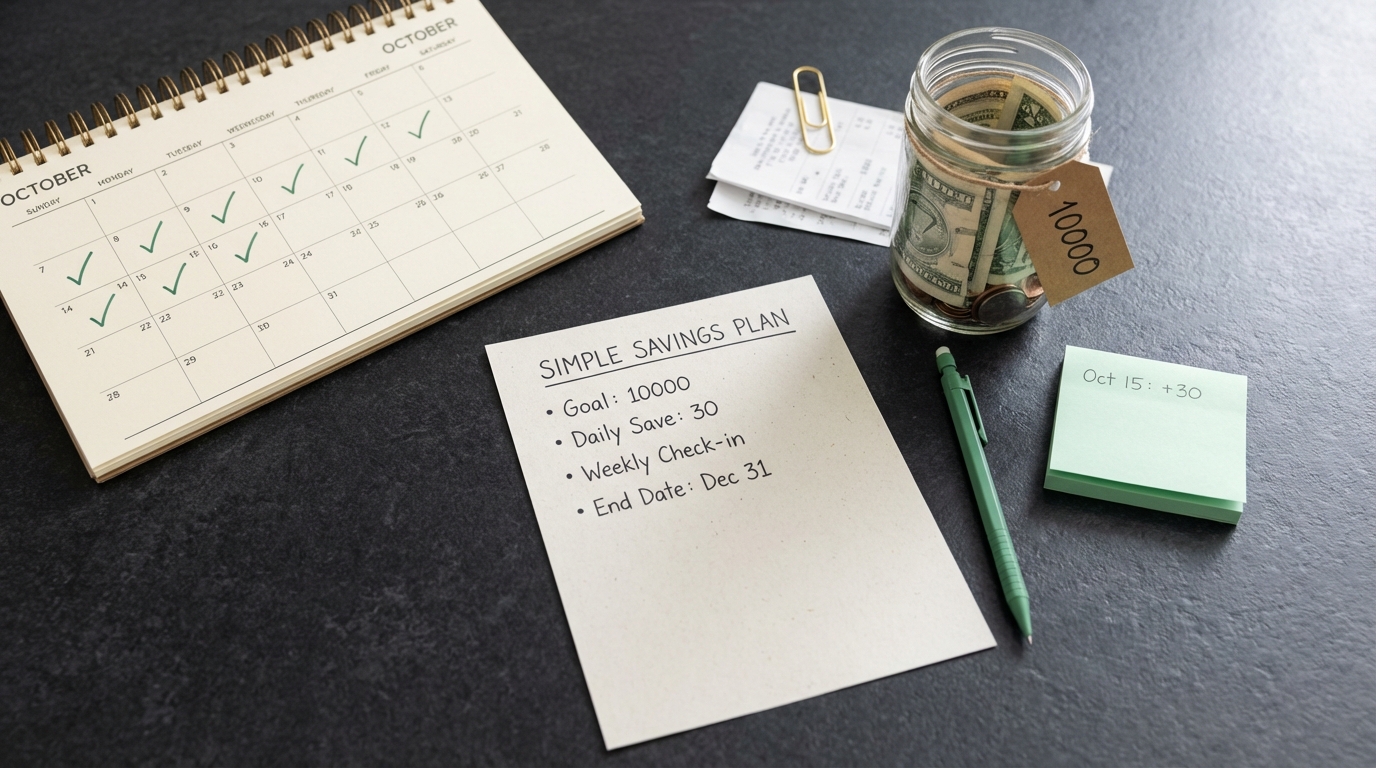

Try a daily or monthly savings plan

Try a daily or monthly savings plan for one short-term goal, then test automation and simple tracking to see what cadence fits your cash flow.

To see the same target in other cadences, $10,000 divided across common periods equals about $833.33 per month or roughly $192 per week. Bankrate and similar sources often present both monthly and weekly equivalents so readers can pick the cadence that matches paydays and bills Bankrate breakdown on saving $10,000.

Using the daily number is a framing device, not a rule about where to keep the money. The figure helps with planning and habit building, but the next steps depend on liquidity needs and whether you want to accept market risk for potential returns.

Why daily framing helps you reach short-term goals

Small, clear numbers are easier to act on. Telling yourself to save a single modest amount each day reduces decision friction and can make the target feel doable. Behavioral research and practical guides recommend breaking large goals into smaller, repeated actions to increase follow-through; the CFPB highlights that specific, automated targets improve the odds of meeting savings plans CFPB savings guidance.

Mental accounting is another reason daily amounts work. When you separate a target into a daily line item, it becomes part of routine spending decisions instead of a distant goal. For people paid weekly or monthly, the same math still applies, but you match the cadence to pay frequency so transfers do not cause short-term cash strain.

A simple math check - daily, weekly, monthly conversions

Do the arithmetic step by step to confirm the rule. Start with the annual target: 10,000. Divide by 365 days to get the daily amount: 10,000 / 365 = 27.397... which rounds to about 27.39. Sources that present daily breakdowns show this same basic arithmetic and the plain result helps readers plan contributions Bankrate breakdown on saving $10,000 and a practical savings goal calculator is available from Bankrate for planning savings goal calculator.

For monthly and weekly conversions do the simple divides: monthly, 10,000 / 12 = 833.33 per month; weekly, 10,000 / 52 = about 192.31 per week. These equivalents let you match the plan to pay cadence or to occasional extra contributions from overtime or side income NerdWallet guide on saving $10,000.

Breaking a yearly goal into a small daily or monthly contribution reduces friction and makes consistent action easier, especially when you automate transfers and track progress.

If your calendar includes a leap year, use 366 days instead of 365. If your plan expects bank or platform fees, or if you plan to pay taxes on investment gains, add a small buffer to the target before dividing so you do not fall short; Investopedia and other finance explainers note that fees and expected returns change the required contribution when you move money into investment vehicles Investopedia explanation on save versus invest.

Remember the framing: the math shows what to set aside if you keep the cash untouched for the year. If you plan to invest, expected returns can lower the daily amount but introduce variability and possible declines along the way.

A step-by-step plan to use the rule

1. Set the goal and timeframe. Write the objective in plain terms, for example: "Save 10,000 in 365 days." Confirm the number you will divide and whether you want a small buffer for fees or rounding.

2. Compute the cadence that fits you. Use the daily, weekly, or monthly equivalents and choose the one that matches your paydays. If you are paid monthly, the 833.33 monthly figure will usually be easier to match with automatic transfers.

3. Create a dedicated place to hold the money. A separate account or bucket reduces temptation to spend the cash, and it makes tracking clearer. The CFPB and consumer guides suggest a distinct account or bucket to improve visibility and results CFPB savings guidance.

4. Automate transfers. Set up recurring transfers timed with paydays so the movement happens before discretionary spending. Automation reduces the need for repeated decisions and tends to increase completion rates according to reputable consumer finance advice NerdWallet guide on saving $10,000.

5. Monitor and adjust. Check progress weekly or monthly and adjust amounts if your income or expenses change. If you miss transfers, replan the remaining cadence rather than abandoning the goal.

Choosing a cadence is practical, not moral. If daily transfers feel like busywork, a monthly transfer timed with paydays usually works better and keeps your cash flow predictable.

Save versus invest, decision criteria

When cash savings is preferable

Short-term targets that must be available on a known date, or funds held for an emergency, generally belong in cash. Cash in a separate account preserves principal and avoids short-term market risk, which is important if you will need the money within a year or two The Balance plan for saving $10,000.

When investing may make sense, how do you start investing

If your timeframe is longer than a year and you can accept market ups and downs, investing can lower the regular contribution needed to reach the same nominal target because expected returns compound over time. That said, investing introduces volatility and the outcome is not guaranteed, so compare the trade-offs against your emergency fund and cash needs before moving funds into investments Investopedia on save versus invest.

Deciding where to place short-term cash depends on scope and risk. If you decide to invest a portion, consider a diversified, low-cost approach and confirm you have a separate emergency cushion to avoid selling investments at a loss if you need cash unexpectedly CNBC Select on smart savings steps.

How to automate and track progress

Use simple tracking tools. A weekly check-in, a three-column spreadsheet, or a bank progress feature is usually enough to see whether you are on track. The key is consistency, not complexity; you can also try tools such as the SEC savings goal calculator for a quick plan Savings Goal Calculator.

Quick planner to convert annual target to daily, weekly, monthly amounts

Use round numbers for transfers

Example automation setups: if paid biweekly, schedule transfers on each payday for a smaller amount that sums to the required weekly or monthly total. If paid monthly, a single transfer timed with salary can be easier to manage. Adjust the amounts after a monthly review to keep the plan realistic.

Tracking routines can be lightweight. Mark a calendar entry to check balance and transfers once a week. If you prefer a digital approach, set a recurring reminder and update a single spreadsheet line with the total saved so far and remaining days. For a local-view calculator, MoneySmart also offers a savings goals tool savings goals calculator.

Common mistakes and pitfalls to avoid

Do not drain an emergency fund to hit a short-term target. Emergency savings exists to cover unexpected costs and using it undermines financial safety. If you need extra cash for the goal, look for small discretionary cuts or a temporary increase in income rather than tapping the emergency cushion The Balance plan for saving $10,000.

Avoid treating the $27.39 rule as an investing strategy. The arithmetic shows the amount you would set aside in cash; it does not reflect returns or risk associated with investing. If you move money into investments, accept that returns can be variable and outcomes may differ from expectations Investopedia on save versus invest.

Watch for fees and tax effects. Certain accounts or platforms charge fees that reduce net savings, and investment gains can be taxable depending on account type. Build a small buffer into the target if you expect charges so you do not fall short at the deadline.

Practical scenarios and example plans

Example: tight budget monthly plan

Imagine a reader with limited flexibility who is paid monthly. They choose the monthly cadence: 833.33 per month. To make room for the transfer they review small discretionary items such as streaming subscriptions or dining out and move one or two modest expenses into a temporary pause. Automating the 833.33 transfer on payday creates a predictable plan; periodic check-ins help keep the budget balanced NerdWallet guide on saving $10,000.

Example: using part cash and part investing

A different reader keeps a cash cushion equal to one or two months of living expenses and places any extra savings into a diversified investment account for a 12 to 24 month outlook. This reduces some of the daily pressure while keeping short-term liquidity. Be aware that investing a portion exposes the plan to market movement, and the expected reduction in required contributions depends on realized returns rather than guaranteed gains Investopedia on save versus invest.

How to scale the plan for different targets

The same method scales to smaller or larger goals. For example, halve the annual target to reach 5,000 and divide by the same periods, or increase the cadence to a two-year period and recalculate daily amounts accordingly. Scaling uses the same arithmetic and the same decision factors about liquidity and risk Bankrate breakdown on saving $10,000.

Checklist and next practical steps

Quick checklist: set the target, pick daily or monthly cadence, open a separate account or bucket, automate transfers timed with paydays, and review progress weekly or monthly to adjust if needed CFPB savings guidance.

Keep or build an emergency fund before committing all your discretionary cash to a one-year goal. If you need help deciding between saving and investing, compare your time horizon, emergency cushion, and comfort with market risk before moving money into investments The Balance plan for saving $10,000.

FinancePolice provides plain language explainers to help readers understand the trade-offs and practical steps for short-term goals and next steps for financial learning.

It is a simple framing device: saving about $27.39 per day will total roughly $10,000 over 365 days. It helps turn a yearly target into a manageable daily or monthly contribution.

If you need the funds within a year, cash is usually safer because it preserves principal. Investing can reduce required contributions over longer timeframes but adds market risk and possible variability.

Set up a recurring transfer with your bank timed to paydays, use a separate savings bucket, and create a simple weekly check to monitor progress.

References

- https://www.nerdwallet.com/article/saving/how-to-save-10000

- https://www.bankrate.com/banking/savings/how-to-save-10000/

- https://www.consumerfinance.gov/consumer-tools/savings/

- https://www.bankrate.com/banking/savings/saving-goals-calculator/

- https://www.investopedia.com/how-to-save-10000-5088142

- https://www.thebalance.com/how-to-save-10000-in-a-year-1289587

- https://www.cnbc.com/select/how-to-save-10000/

- https://financepolice.com/advertise/

- https://financepolice.com/how-to-budget/

- https://financepolice.com/category/personal-finance/

- https://financepolice.com/

- https://www.investor.gov/financial-tools-calculators/calculators/savings-goal-calculator

- https://moneysmart.gov.au/saving/savings-goals-calculator